The biggest problem with Utility M&As, and How you can fix it

“The way for power and utility companies to thrive & stay competitive is to ensure they’re making growth & capital spending efficiency a priority,” says Regina Mayor. Companies are rethinking the future of their businesses as the centralized model (schedulable, predominantly large, thermal or nuclear plant) is transitioning to a hybrid and distributed model. The trigger behind this transformation has been pulled by a combination of technological, policy and consumer change causing disruption. Deloitte’s speculation that the companies cannot afford NOT to change is seconded by Mayor as she quotes “This new ‘lower for longer’ commodity pricing environment has made it necessary for energy executives to devise new ways get access to capital to fund short- and long-term strategic activities”.

The Real Challenge

With inelastic budgets and credit crisis, power and utility companies need to realize the fact that business-as-usual is no longer an option for them. Amidst an industry inundated by challenges of organic growth and a receding economy, the biggest drivers of M&A activity are identified as the persistence of low commodity prices, and consolidation of key businesses. Underlying rationale of these drivers is to enter asset classes and new business lines (47%), entering new markets and expanding geographic reach (34%), and expanding customer bases (36%).

The real challenge by utilities is encountered in effective planning, and integrating the two entities entering the M&As to realize the financial, operational and strategic gains that prompted the deal in the first place. The incompetent execution of integrations not only delays the realization of end-state benefits but also erodes shareholder value, creates employee-base confusion, disrupts the current operations and fails to address cultural differences.

Fit for the future: Next Generation Integration

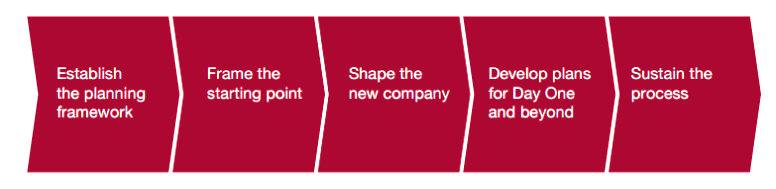

Exhibit 1 above illustrates the steps the merging organizations need to prepare for a successful close and for seamless operation integration. Success in capturing transformational value requires a flexible integration approach that allows leadership to chase transformational value sources along with combinational value. With rigorous analysis and integration management, companies can surpass the capabilities of countless firms and M&A professionals. Promising next generation integration technologies are enabling Power & Utility firms to accelerate operational efficiency, improve customer service, defer investment in new power generation and deploy the unexpected amount of big data collected for business performance improvement. Across the globe, the utility executives are revisiting the comparative benefits of vertical integration: avoiding transaction costs; integrations aids in hedging against volatility; and allows a utility to tap various profit pools.

What the Future Holds?

The power sector companies, failing to stay ahead of change, are liable to major decline or death spiral. The challenge will be to gain the most of the market opportunity by transitioning to the new business models as the transformation of energy takes hold. Approaching the question of integration, executives need to understand the comparative advantages they can gain by vertical integration through less market exposure, decreased transaction cost and the capability of out-investing the competition by tapping into different profit pools. While the regulatory requirements and regional demand may call for varied models, it is evident that structural evolution has become a necessity in the industry to adapt to new technologies and market participants.